Financial freedom planning is often referred to as “the hardest problem in finance,” and for good reason. The process involves navigating a web of variables and assumptions, each of which carries its own set of uncertainties. When you start calculating the numbers, whether on your own or with the help of an investment advisor, you quickly realise the complexity involved. You need to assign values to a variety of factors, such as expected returns post-retirement, inflation during retirement, life expectancy, post-retirement expense estimates, and many more.

The challenge, however, lies not just in making these assumptions but in the inevitable changes that occur between the present day and the years ahead. Even if you make conservative assumptions and try to plan with the best intent, the reality is that the values of the chosen variables can shift in ways that are impossible to predict. Over the decades leading to your financial independence, market conditions will change, life events may alter your trajectory, and personal circumstances such as health, family obligations, or unforeseen expenses can dramatically impact the assumptions you made at the outset.

The next step in understanding these challenges is to look at real-world examples, such as the projected annual expenses over time, which can help paint a clearer picture of the financial requirements needed to maintain a comfortable lifestyle. Attaining financial freedom requires a deep understanding of projected expenses, inflation, and the power of early investments. Let’s calculate how much is required for financial freedom. The process is to first calculate the amount that is required to handle cash flows and monthly expenses required post retirement. The second part is to calculate the money required to handle major life events.

Recurring Expenses

The graph presented outlines the projected annual expenses over time for someone with an average expenses of ₹18,00,000 at the age of 40 based on an inflation rate of 9%. These projections help in understanding how living expenses grow as a person ages and the crucial financial planning required to sustain a comfortable lifestyle in later years.

Reaching age 50 with ₹42.6 lakh in annual expenses is a reminder that if you want to retire comfortably and live without financial stress, you need to have sufficient resources in place. To cover these expenses , we need 42 lakhs * 30 around 12 crores. Relying solely on income from a job may not be enough; consistent investment growth is crucial to sustaining long-term financial security. Building a diversified portfolio, investing in assets that appreciate over time, and ensuring a steady income stream can help secure a worry-free retirement while maintaining your desired lifestyle.

By age 50, the person’s expenses have already risen substantially, and this expense gap will continue to grow until age 70 and beyond. The projected expenses at 70 (₹2.39 crore) and 80 (₹5.65 crore) emphasise the need for financial independence, where your investments generate enough returns to cover these costs.

The earlier you start investing, the less you will have to invest to build a higher corpus. Let us assume a 35-year-old investor starts investing a sum of Rs. 1,00,000 per month. Assuming he will become financially free at the age of 50, he would have invested a sum of 1,80,00,000. Assuming an average return of 24%, the investor would have a more than sufficient corpus at retirement.

Now if the same investor had waited for another five years to start this planning and began at 40 years of age, even a higher investment per month would not have generated such a high corpus.

Major life events

This graph showcases two key categories:

Assuming a family with 2 kids.

– Marriage: Initially, the required amount for marriage is ₹10,000,000.

– Education: The initial amount required for education is ₹10,000,000.

– House: The initial amount required for buying a house is ₹20,000,000.

Both amounts are projected to increase over the next 10 years due to inflation, and the graph shows the inflated amount for both expenses after 10 years.

– Marriage: ₹10,000,000 grows to ₹23,674,000.

– Education: ₹10,000,000 grows to ₹23,674,000.

– House: ₹20,000,000 grows to ₹47,348,000.

– Total Expenses: ₹94,696,000 (or ₹9.47 crore)

Amount required for retirement = 12 crore to cover expenses + 9.47 crore to cover major life events.

Waiting until closer to the time of these events may not allow you to accumulate enough to meet the inflated expenses. To keep up with these rising costs, a good strategy is to invest regularly and take advantage of compounding returns. There is no perfect method of calculating your financially free target. Investment performance will vary over time, and it can be difficult to accurately project your actual income needs. There are other potential considerations as well. Many people have had to shift their plans to later than they planned. For example, about 3 million workers retired later than they anticipated because of the COVID-19 pandemic.

Investing

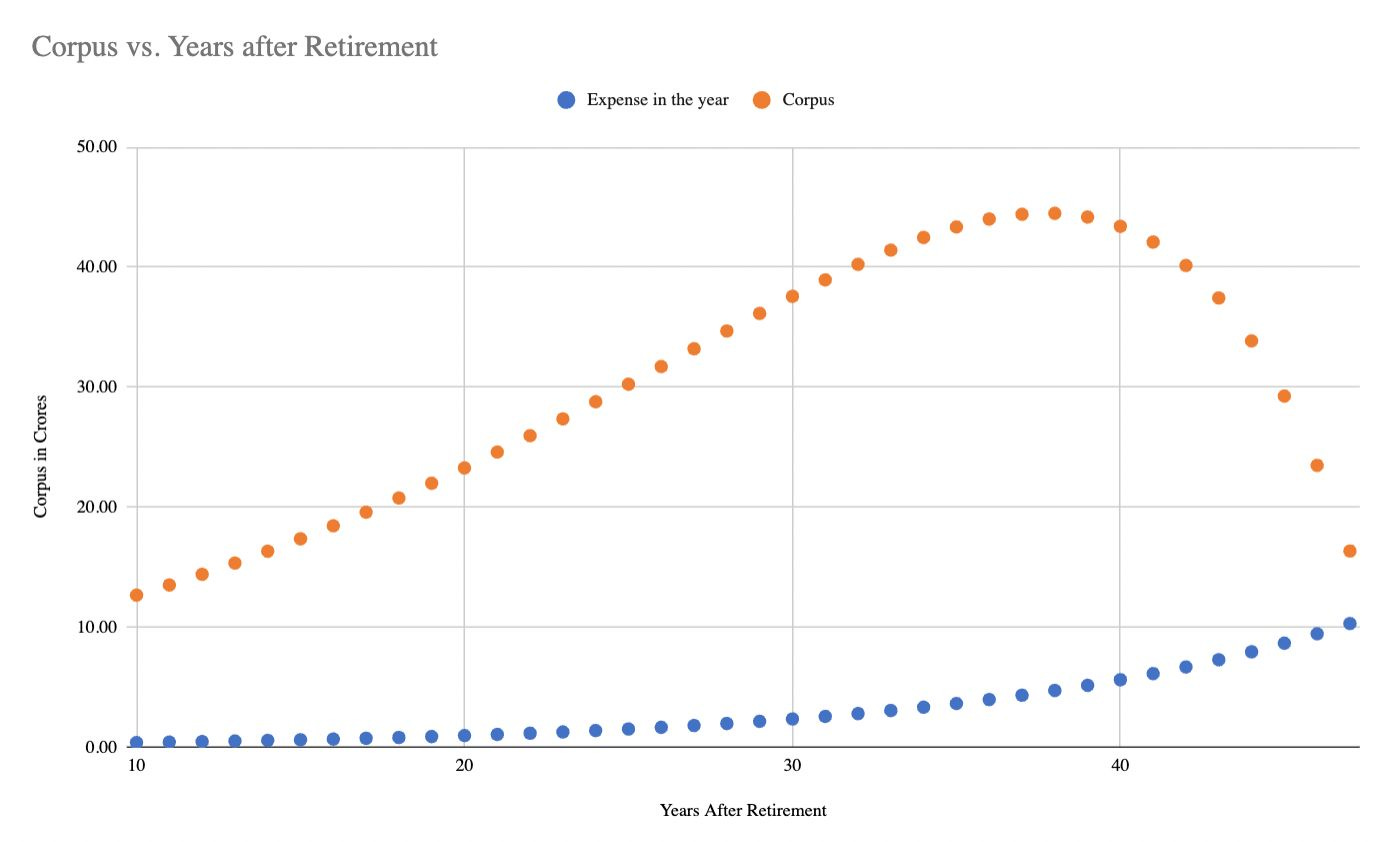

In the initial years of retirement, even though withdrawals are being made to cover yearly expenses, the retirement corpus (the total savings/investment fund) still grows. This happens due to the power of compound interest or investment returns.

– The corpus starts at ₹12 crore. Not including 9.47 crores as this amount will be used to cover life events and will not be available to handle expenses.

– It grows significantly in the initial years, peaking around 30-35 years after retirement.

After reaching the peak, it starts declining as withdrawals exceed investment returns, eventually depleting towards the later years.

If the corpus is large, even a moderate percentage of returns (e.g., 8-10%) can result in substantial growth. For example, at 8% annual returns, ₹12 crore generates ₹96 lakh per year, which can cover rising expenses while allowing the corpus to increase. As the corpus grows larger each year, the returns (a percentage of the corpus) also increase. Thus, the balance between returns and withdrawals is what allows the corpus to grow.

As expenses grow due to inflation, the corpus starts depleting, but the slow decline ensures sustainability up to 96 years. The key balance is between withdrawals and investment earnings, preventing premature depletion. Attaining financial freedom requires a proactive and strategic approach to managing both recurring and one-time expenses. By starting early and consistently investing, you can use the power of compounding to build a substantial corpus that grows with time. This ensures that your finances not only keep pace with inflation but also provide the flexibility to achieve life goals and maintain a comfortable lifestyle.

How much is too much? What % of us have unlimited wants?

A study of almost 8,000 people from across the world by University of Bath found that in India more than 69% of people said they would like $1m or less to achieve their ideal life.

Today, there is a pervasive belief that more money directly translates to more happiness. However, as Jachimowicz, an assistant professor of Business Administration at Harvard Business School, suggests, if we focus solely on the happiness that money can bring, we may be overlooking an important aspect of wealth: the freedom it provides from worry. “We also need to think about all of the worries that money can free us from,” Jachimowicz emphasizes. In other words, while money may not guarantee lasting happiness, it can alleviate certain stresses, such as financial insecurity, health-related concerns, and lack of opportunity that can hinder well-being.

The younger generation tends to desire more, more possessions, more experiences, and more financial resources. Their fear of inflation and an uncertain future drives them to accumulate wealth, often believing that more is better. In contrast, older individuals tend to be content with less, having gained a clearer understanding of the moderation needed for a fulfilling life. This shift in perspective is, in part, a natural function of how people perceive inflation and financial stability over time.

Dr. Paul Bain, a lead researcher and reader at the Department of Psychology at the University of Bath, addresses the consequences of this mindset. He points out that the ideology of “unlimited wants”, often portrayed as an inherent part of human nature, creates significant social pressure for individuals to buy more than they actually need or desire. This constant drive for material accumulation not only contributes to dissatisfaction but also consumerism and environmental degradation.

In his research, Bain suggests that most people’s ideal lives are far more moderate than society’s prevailing expectations. If individuals realised that they could be happy with less, it could lead to more sustainable consumption patterns and, consequently, a healthier planet. Furthermore, this understanding could pave the way for stronger social policies that encourage a shift from relentless consumerism to more balanced, purpose-driven living.

Take a moment to imagine your “dream life.”

If you never had to think about money.

– Where would you live?

– How would you spend your days?

– What luxuries would you indulge in?

Have a clear picture of what your absolute ideal life would look like?

– List out Expenses

– Take into account inflation

– Tax and Investments

– Make Future Growth Projections

While planning for financial freedom is crucial, it comes with a significant level of uncertainty. The very nature of the task requires flexibility and a recognition that nothing is static. These shifting variables make long-term financial planning both a challenge and an ongoing process of adaptation, demanding regular reviews and recalibrations as you move closer to your retirement goals.