Personal Life

Ravi Handa’s story(https://x.com/ravihanda) is one of relentless perseverance, calculated risks, and a proper understanding of his own capabilities. Born and raised in Rajasthan, he was a diligent student from an early age, prioritising academics, particularly in science subjects. Despite attending good schools, he faced limitations when it came to coaching opportunities in Jaipur in 1999.

His efforts paid off when he secured admission to IIT Kharagpur, where he pursued computer science. A conversation with him revealed the struggle and the determination that helped him achieve this milestone. It was just the beginning of a remarkable journey.

Early Career

Ravi began his career with IMS Learning Centre, a well-known institution for CAT coaching. Within IMS, three career trajectories were common: transitioning into management, opening franchise centres, or continuing as a teacher with limited upward mobility. However, he was quick to notice a shift in the education landscape, the growing acceptance of online learning. Realising the first-mover advantage, he ventured into entrepreneurship, founding Maurya Learning Pvt Ltd. This initiative, though unsuccessful, became a testament to his resilience and his willingness to experiment, adapt, and try again.

Undeterred by the setbacks, Ravi founded Handa Ka Funda in 2012, offering online MBA coaching. Convincing people to study online was a significant challenge—trust in digital learning was low, and many students were skeptical about the effectiveness of virtual classes. Internet connectivity issues further compounded the problem, limiting access to seamless online education. To bridge this gap, Ravi introduced pen drives with preloaded video lectures, allowing students to access quality education even in areas with unreliable internet.

His previous attempt had not yielded the expected market response in 2008–09, but this time, his keen insights and the evolving digital landscape worked in his favour. The launch of Jio in 2016 changed the game entirely. With affordable high-speed internet becoming widely available, online education saw massive adoption, and Handa Ka Funda flourished like never before. The surge in internet access meant that students no longer needed pen drives—they could stream content directly. This technological shift fueled the growth of Ravi’s business, establishing Handa Ka Funda as a trusted name in the edtech space. The business flourished, earning credibility and recognition. When potential customers began reaching out to him for his YouTube videos on MBA coaching, he realised the true impact of his work and the trust he had built. However, by 2018, competition intensified, with multiple new players entering the market. As larger platforms expanded aggressively, Ravi anticipated that sustaining long-term profitability in the fiercely competitive landscape would become increasingly difficult.

The Acquisition by Unacademy

Despite facing market competition, Ravi stood his ground. He understood that MBA coaching is a cyclical business with variable profits. Predicting a decline in profitability due to increasing competition, he made a strategic move, selling Handa Ka Funda to Unacademy rather than waiting for the business to become unsustainable. This decision not only ensured financial security but also allowed him to exit on his own terms, without leaving a lot of money on the table.

The Hidden Stress of Early Retirement

What’s often overlooked is the anxiety that follows FIRE. Financial fears don’t magically disappear—market volatility, sudden economic downturns, and unexpected life events can disrupt even the best-laid plans. And beyond money, there’s a psychological identity crisis. When your entire life has been defined by your job title, what happens when you no longer have one? Early retirees often struggle with this transition, making excuses or finding new ways to justify their time. Friends and family assume they are always available, leading to social pressures they never anticipated. The mental adjustment can be just as demanding as the financial one.

Rethinking FIRE: Freedom or Just Another Illusion?

In India, the concept of Financial Independence, Retire Early (FIRE) is gaining traction, yet it remains misunderstood. For many, financial independence means escaping the relentless corporate grind, breaking free from toxic workplaces, and gaining the power to say “no” when needed. But in a country where financial security is often tied to traditional jobs, FIRE is more than just a number in a bank account; it’s a psychological shift, a lifestyle decision that comes with its own challenges.

The expectations around FIRE can be misleading. Many assume that early retirement equals endless leisure—traveling to 50+ countries, sipping coffee in European cafés, and living a stress-free life. But real financial independence is about choice, not escape. It doesn’t guarantee happiness, nor does staying in the rat race mean inevitable misery. Someone working in a high-stress corporate job could still be happy, despite long hours and demanding targets. Another might achieve FIRE but struggle with the emptiness of not having a clear purpose. The point isn’t to glorify or dismiss either path—it’s to recognize that true fulfillment comes from balance, not extremes.

Ravi believes FIRE isn’t an escape plan; it’s a mindset shift. He thinks it should empower people to make choices—not force them into new expectations of how life “should” look. It is about having the ability to walk away from what doesn’t serve you, whether that’s quitting a toxic job or working on your own terms. It doesn’t have to mean retirement in your 30s; it can mean financial security in your 40s, career flexibility in your 50s, or just the confidence to take a break when needed.

According to Ravi, it’s easy to compare yourself to batchmates who became millionaires or friends still grinding in corporate jobs. But real success is deeply personal. Some thrive in high-pressure environments; others find joy in stepping away. Instead of chasing an idealized version of success—the real question to ask is: What kind of life do you want to build?

Financial Independence

Post-acquisition, Ravi pivoted his focus to financial independence and early retirement (FIRE), a philosophy that he now passionately shares through the Desi FIRE Podcast on YouTube. He believes that individuals should assess the true value of their jobs against their personal well-being. He strongly advocates for work-life balance, fair employee treatment, and the power of financial freedom. According to him, many employees remain trapped in unfavourable work environments due to financial constraints. Achieving financial independence, in his view, gives people the power to reject and walk away from undesirable situations.

Money Management and Smart Investing

Ravi approaches financial independence with a deeply personal and practical mindset, emphasising:

– Effective Money Management: Ensuring one can live comfortably without the risk of running out of money.

– Benchmarking Investments: Questioning traditional benchmarks like mutual funds and indexes, and focusing on personalised financial strategies.

– Pragmatic Decision-Making: Understanding market trends, adapting to changing circumstances, and making informed financial choices.

Effective Money Management

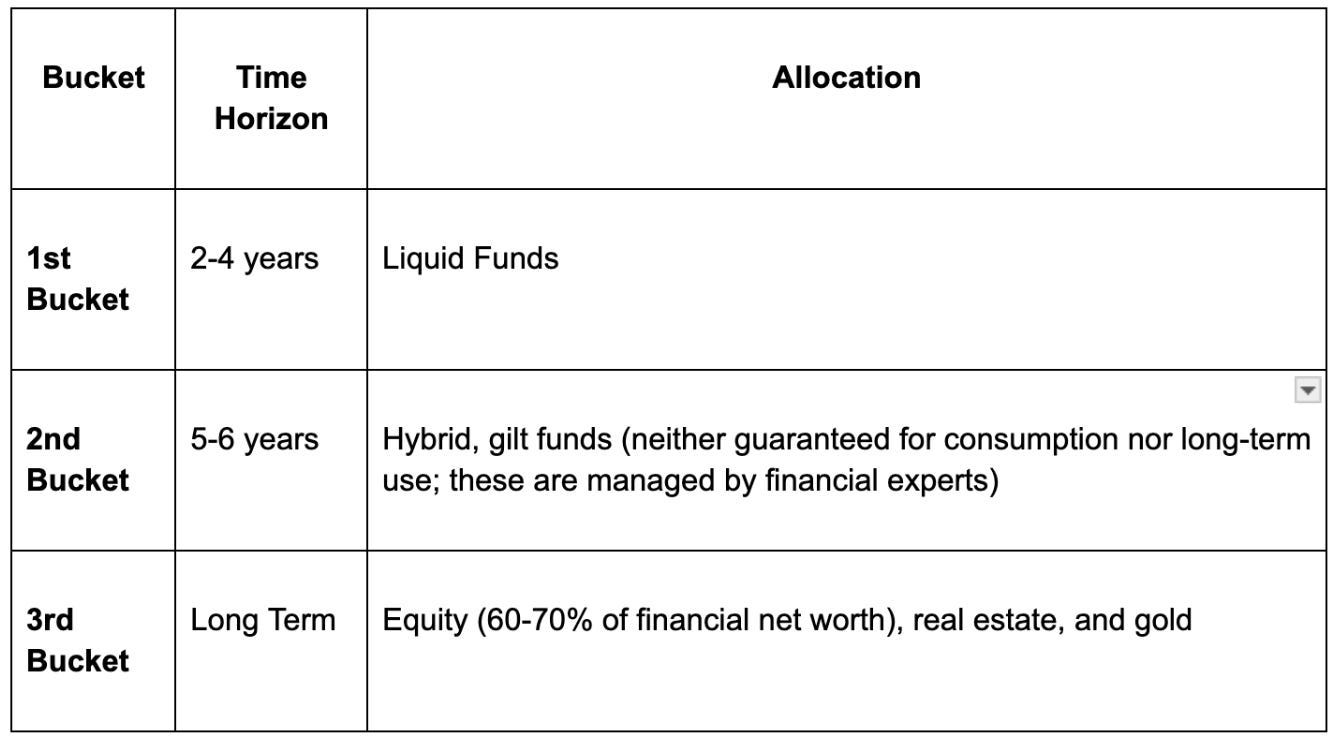

Bucket Strategy for Time-Based Allocation:

His Specific Investment Considerations

Term based Financial Planning:

– Long term (10+ years) investments are mostly in equity with some real estate exposure.

– Short term (Less than 2 years) investments are mostly in liquid debt funds.

– Medium term funds are in hybrid fund and GILT funds

– The aim is to maintain equity between 60-70% of the financial net worth.

Investment Strategies:

– Focus on asset allocation

– Focus on cash flow management for day to day expenses

– Making decisions based on deep dives into specific investment opportunities.

– Making decisions about where to allocate funds based on market conditions.

Example: Allocating ₹20 lakhs based on current market opportunities as markets have corrected a bit in early 2025.

Rebalancing Equity-Debt Allocation

Ravi follows a structured yet flexible approach:

– Once around Holi, once around Diwali.

– The rest is event-based—for example, changes in debt taxation policies.

Debt Fund Considerations

– Gilt Funds: Investing at the peak of the interest rate cycle can be highly beneficial.

– Liquid Funds: These are less volatile and used for consumption.

– Gilt Funds Definition: Mutual funds that invest money in government securities, considered a safer but strategic investment option.

Beyond the Bucket Strategy

While Ravi has used the bucket strategy effectively, he also acknowledges other models that may work better depending on an investor’s discipline and financial goals:

– 60-40 Portfolio: Maintaining a portfolio with 60% equity mutual funds and 40% debt mutual funds and withdrawing 3.5% annually, adjusted for inflation, can yield better results than the bucket strategy.

– CAPE-Based Withdrawal Strategy: Using Shiller’s CAPE ratio, this is considered a highly efficient withdrawal model.

Dynamic Withdrawal Strategy

Balancing spending and portfolio preservation is key in retirement. The dynamic withdrawal strategy adjusts withdrawals based on market performance, offering flexibility while ensuring stability.

How It Works

1. Initial Withdrawal: Start with a set amount based on portfolio size and expenses.

2. Annual Adjustments: Increase withdrawals when markets rise and decrease them during downturns, within set limits.

3. Ceiling & Floor:

– Ceiling: Caps increases to prevent overspending.

– Floor: Limits reductions to maintain a baseline income.

4. Customisation: Adjust ceilings and floors based on risk tolerance and lifestyle needs.

Benefits

– Stability: Prevents extreme income fluctuations.

– Portfolio Longevity: Reduces withdrawals in downturns to preserve savings.

– Higher Spending in Good Years: Allows for increased enjoyment when markets perform well.

– Personalized Approach: Tailor the strategy to individual financial goals.

Implementation Tips

– Regularly review portfolio performance.

– Set realistic ceilings and floors.

– Consult a financial advisor for adjustments.

An Inspiration

Ravi Handa’s journey exemplifies the importance of persistence and adaptability. Ravi lives with the principle that “success isn’t about winning a race, it’s about defining your own finish life. His story is not just about success but about trying again and again until you succeed. From a dedicated student in Rajasthan to an IIT graduate, an entrepreneur, an edtech leader, and now a financial independence advocate, Ravi has consistently embraced challenges with resilience. His life highlights the belief that setbacks are not failures but stepping stones toward greater achievements. His ability to recognise shifts in education, business, and financial markets has allowed him to pivot effectively at crucial moments. Through his Desi FIRE Podcast, he continues to share insights, helping others navigate their own paths to financial independence.

His story captivates and inspires countless individuals to seize control of their careers, finances, and personal well-being. Ravi proves that success isn’t just about reaching a destination, it’s about staying dedicated to the journey, adapting to challenges, and never losing faith in oneself.