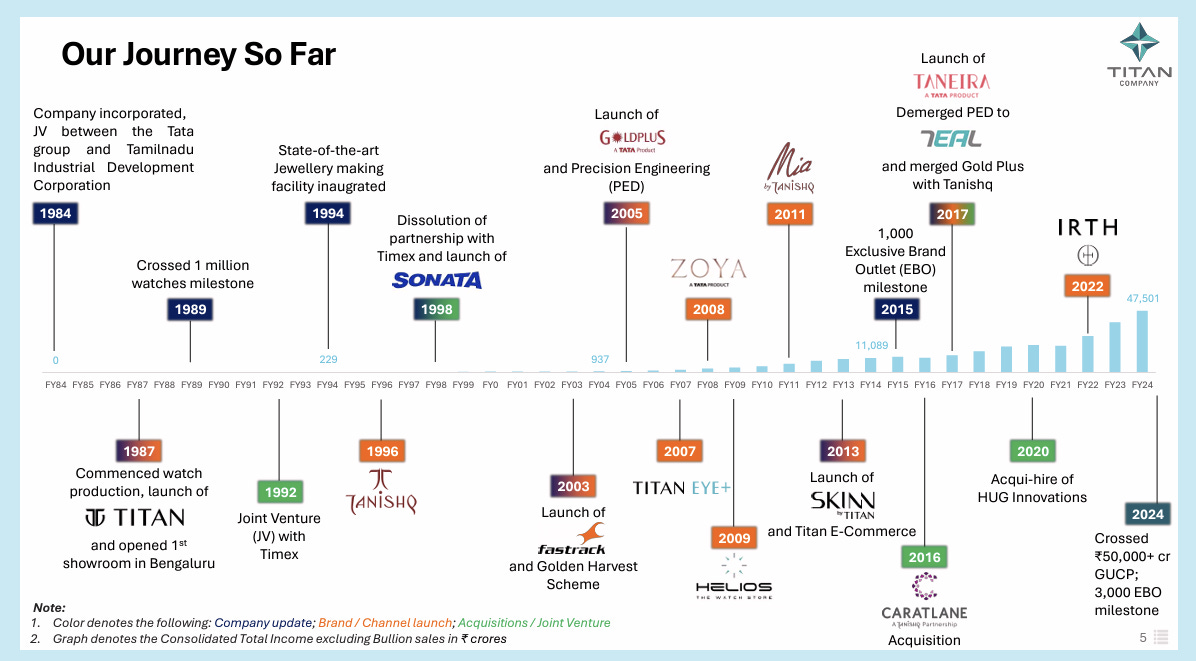

Imagine a company that started with a single watch and grew into a billion-dollar giant—Titan. Today, someone buys a Titan watch every three seconds. Founded in 1984 as a joint venture between TIDCO and the Tata Group, Titan boldly entered a market dominated by Hindustan Machine Tools (HMT).

From day one, Titan was projected as a premium brand. The company offered stylish yet affordable watches, quickly capturing the Indian market and challenging HMT’s monopoly. With this success, Titan then entered European markets. Since Titan was habitual to the Indian Monopolistic environment, it faced a severe challenge in keeping up with the standard and quality of the European markets. Thus, its ambitious expansion in the 1990s proved costly, resulting in significant losses. Despite revenue increasing from ₹700 crore in 2000 to ₹800 crore in 2001, net profits dropped sharply from ₹23.1 crore to ₹10.6 crore, causing continuous declines in stock prices.

Despite this setback, Titan sustained. The company on January 3rd, 2001, was priced at a single-digit price of ₹ 1.35 per share.

In 2002, Bhaskar Bhat took leadership as the managing director. The management was asked to come up with a winding-up plan and bring back the stock, whatever remained. Hence, in 2004 they absorbed the accumulated losses, paving the way for a resurgence. The management absorbed accumulated losses by 2004 and repositioned Titan as a fashion-forward brand targeting young India. A game-changing strategy required retailers to pay in advance, ensuring Titan’s cash flow was secured.

Around this time, ace investor Rakesh Jhunjhunwala recognized the potential of Titan. He bought Titan shares. At the Capital Ideas Online conference in 2000, he said:

"I look at the sheer size of the opportunity, and I also tend to invest in the businesses that markets tend to ignore because that is where the opportunity lies"

He saw Titan as a company with the potential to become a major player in the Indian consumer market, a vision that would ultimately be realized.

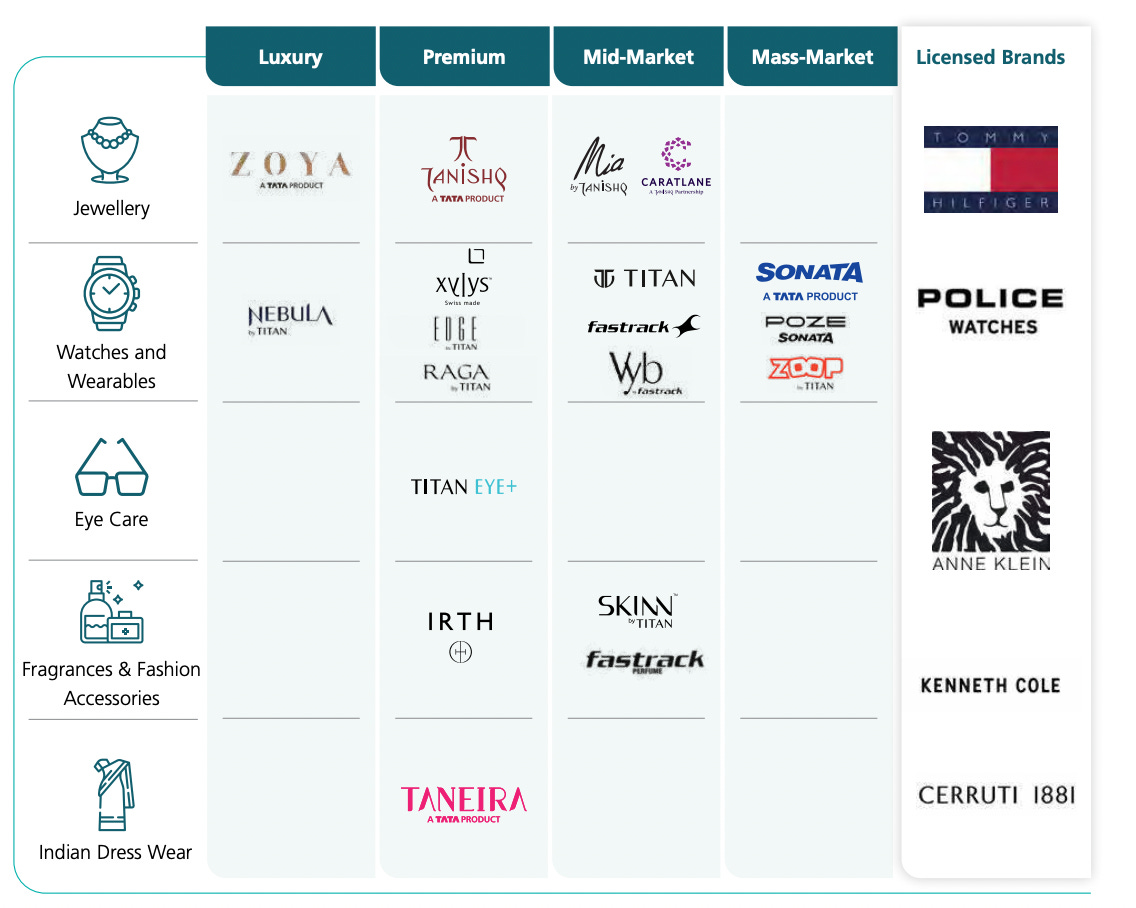

Building on this momentum, Titan Company today stands as a leading player in the lifestyle industry, serving customers through its commitment to quality and exceptional service. Over the years, Titan has successfully cultivated renowned brands in various domains, including Jewellery, Watches & Wearables, EyeCare, Fragrances & Fashion Accessories, and Indian Dress Wear. With a profound understanding of customer preferences, Titan adeptly meets the evolving needs of its customers.

Titan serves customers across diverse segments, as reflected by the plethora of brands it has developed. With offerings spanning numerous lifestyle categories, Titan aims to redefine the modern retail experience by blending innovation with customer-centricity. The Company’s prestigious brands across each business and market segment are unlocking new opportunities for sustainable growth.

The stock price significantly started increasing. Although, there was a fall in stock price from ₹1400 to ₹ 700, because of Covid-19, the company had a negative impact on the ability to be able to provide trial before buying. Hence, this inturn led to decrease in footfall in the store. Investors still held on to the stock. However, Titan rebounded strongly, with jewellery contributing ₹38,352 crore in revenue (20% YoY growth). Watches and wearables generated ₹3,904 crore (18.4% growth), while EyeCare achieved 5.1% growth.

Do you know what happened after that?

The stock grew multifold, from ₹ 750 to more ₹ 3886 per stock!!

This was the integrity of Titan in the markets

Titan entered the jewelry market, introducing Tanishq. Tanishq revolutionized the market with certified 22-karat gold jewellery and transparent pricing. Understanding the needs of working women, Tanishq introduced stylish, affordable designs. The “Impure to Pure” initiative—where customers exchanged jewellery of 19-karat or higher for 22-karat pieces with only making charges—built trust and solidified its reputation. Aggressive retail growth, including over 100 new stores, and a growing presence in North America and the GCC region, have further strengthened Titan’s position.

Today, Titan’s stock price has reached ₹ 3,887 per share. This shows around 2500 times over the last 22 years. This means, if one invested ₹ 1 lakh in this stock, the current value translates to ₹ 25 crore today. (as of December 2024).

As of 2022, Titan had more than 2200 stores, more than 16 brand businesses, over 2.8 million square feet and 7263 employees under the Titan umbrella. This remarkable growth highlights Titan’s success in building a brand that resonates with Indian customer dynamics and it’s ability to adapt to changing markets.

Promising Growth Potential- Titan is viewed as a company with strong earnings growth potential. While Titan’s international business is still in its early stages, it shows promise, and if it grows faster than anticipated, it could boost the company’s earnings further.

Titan’s 2,500x stock growth in 22 years is more than a business success. It’s a blueprint for creating value, seizing opportunities, and staying ahead of trends. For those who believed in Titan early, the journey turned into a fortune, proving that smart investments in trusted brands can yield extraordinary returns.

Titan’s journey teaches us that extraordinary rewards come to those who spot potential before the world does. The question is—are you ready to find your next Titan?