Public expenditure on healthcare has seen a substantial increase from 1.4% in FY18 to 1.9% in FY24. This uptick in spending underscores the government’s goal to position India as a global healthcare hub and plans to raise the public health spending to 2.5% of GDP by 2025.

Projections indicate that the hospital market in India, valued at USD 98.38 billion in 2023, is likely to continue its growth trajectory and expand to USD 193.59 billion by 2032, recording a CAGR of 8.0%

The hospital industry dominates the healthcare market, accounting for 80% of total spending.

The country’s existing bed-to-population ratio is 1.3/1,000 population (private and public hospitals included), with a deficit of 1.7/1000 population, necessitating an additional 2.4 million beds to cater to the existing population

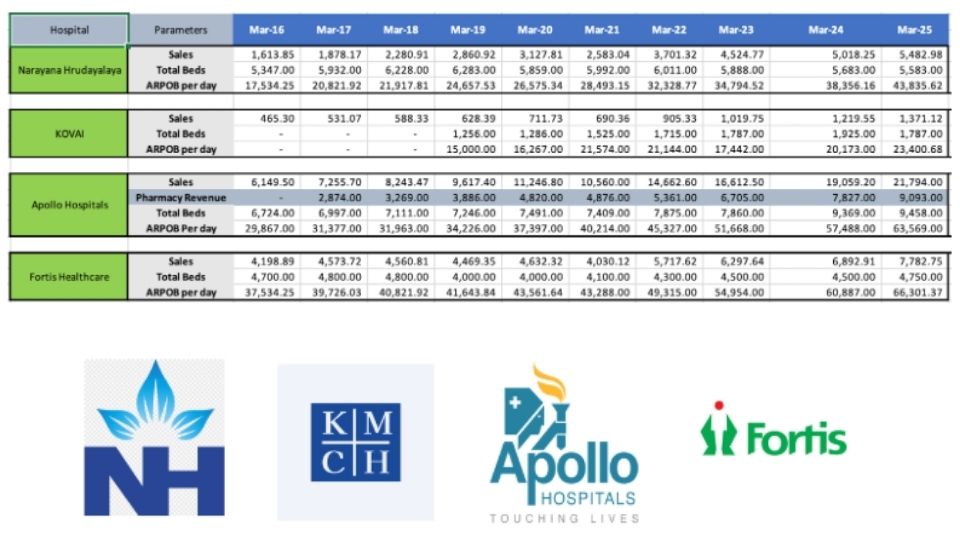

Before we conclude this growth story as remarkable, we think deciphering the past 5 to 10 years of growth of a few major hospitals will give us “on the ground” insight. So here is how the numbers look.

The market share of large hospital chains is expected to grow. Private hospitals comprise 63% of the market, but large chains account for only 12%, according to the latest research by Anand Rathi. Expansion through brownfield projects and in established markets will likely lead to faster breakeven and maturity, leveraging existing demand and brand recognition.

Sales Figures in Rs Cr

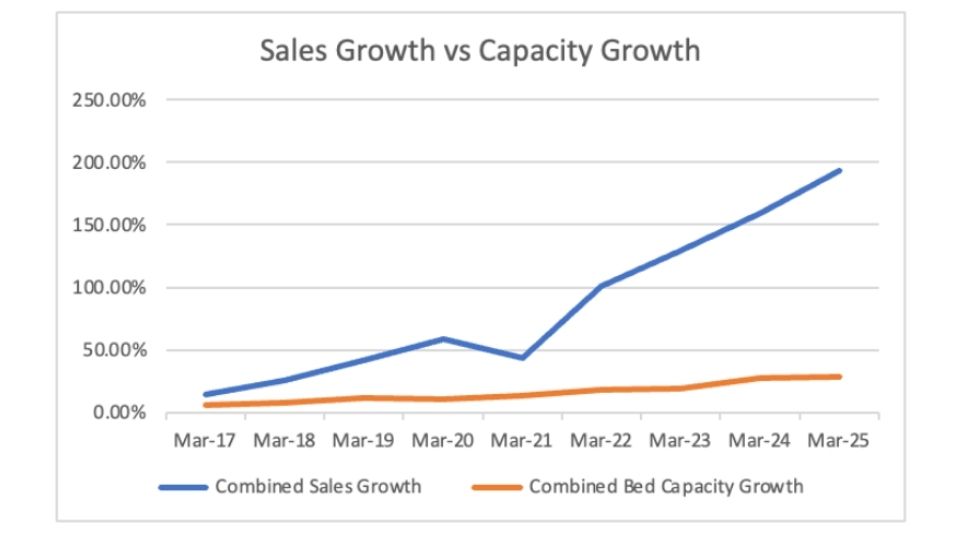

What do we infer from this data? If you look closely at sales growth, it has been 3 to 4 times, but capacity has shown a mere growth of 5 to 10%. But ARPOB (average revenue per bed) has grown at a typical 1 to 2 times.

Narayana Hrudayalaya’s sales grew from ₹1,613 Cr (5,347 beds) in FY16 to ₹5,483 Cr (5,883 beds) in FY25 — over 3.4x revenue growth with only a 10% bed increase, highlighting stronger utilization and pricing.

This efficiency is also reflected in ARPOB per day, which surged from ₹17,534 to ₹43,853 during the same period

So again is growth real or a steep medical inflation which hospitals were able to pass because of the scarcity of facilities and beds?

This implies the growth driver of the past 5 years has been the medical inflation or value chain upgrade of multi-speciality hospitals and as this peaks, growth seems difficult without capacity expansion. And that’s what typically is happening around the industry.

Be it any hospital chain, a typical expansion of 50% to 100% is planned by all major players.

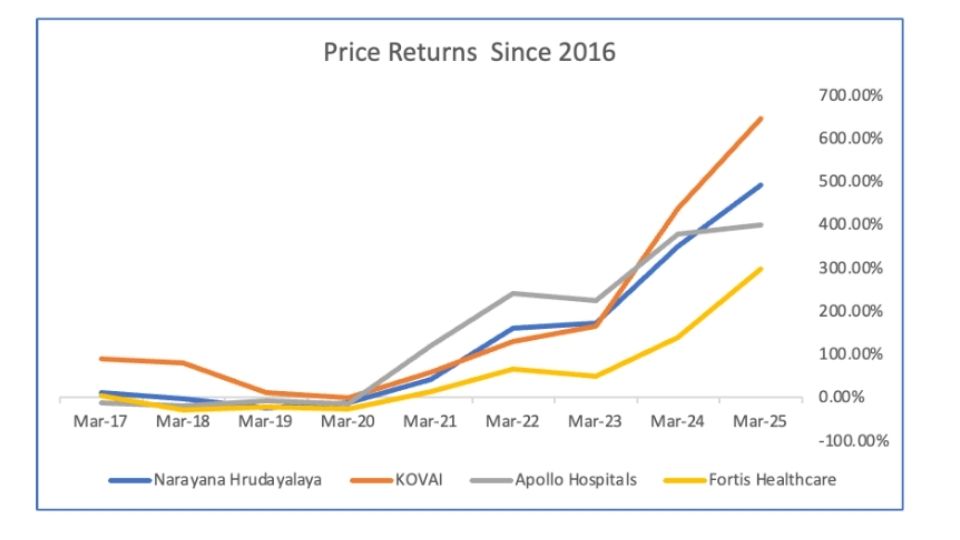

Now as an Investor, how should we pinpoint the best opportunity and “Make Wealth From Health”?

To unveil this in depth analysis and answer the question – “Read Make Wealth from Health” in our next read

References- Annual reports of mentioned hospitals.

This is article is solely written for educational purpose and should not be taken as investment advice.