Every earnings season tells a story. This one is about resilience, but also about imbalance. On one hand, profits and margins are improving. On the other, revenue growth is slowing, especially for smaller firms. Larger players are once again proving their strength, while some sectors are shining and others are clearly struggling.

This blog breaks down the quarterly results using the data provided, followed by deeper research to explain the “why” behind the numbers and what to expect in the quarters ahead.

Sector Performance Highlights

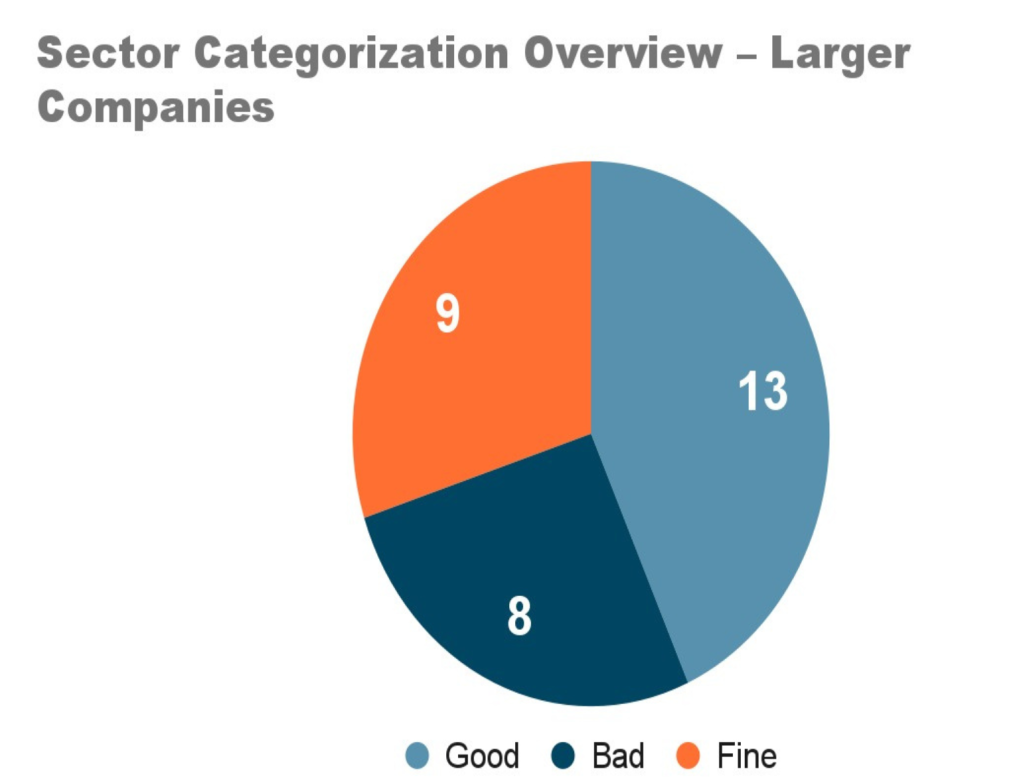

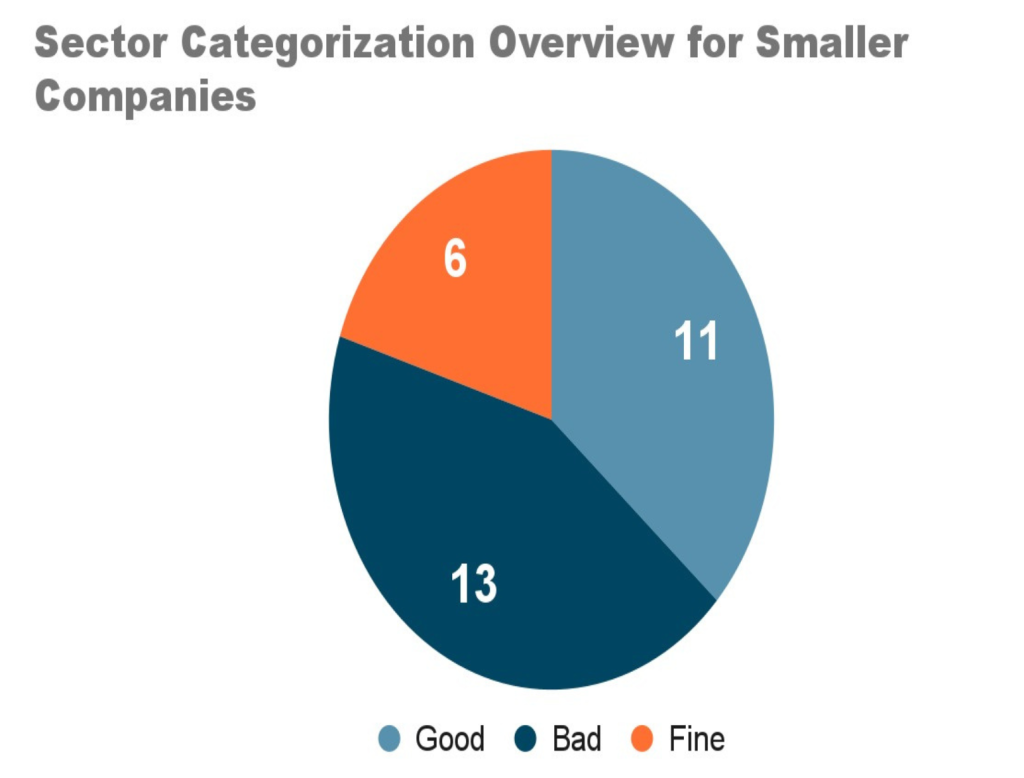

The sector analysis shows some interesting differences between large and small companies. For the bigger players, 13 sectors look strong, 8 are underperforming, and 9 are somewhere in between. On the other hand, for smaller companies, only 11 sectors are doing well, 13 are struggling, and 6 are in the middle. This clearly points to a weaker overall picture on the smaller-company side

Industry-Wide Growth Snapshot

Year-on-year sales growth was limited to 6.4%, reflecting a muted performance and indicating some softness in topline momentum. EBITDA grew by 10.4% and PAT increased by 9.7%, though both remain modest in comparison to stronger growth periods.

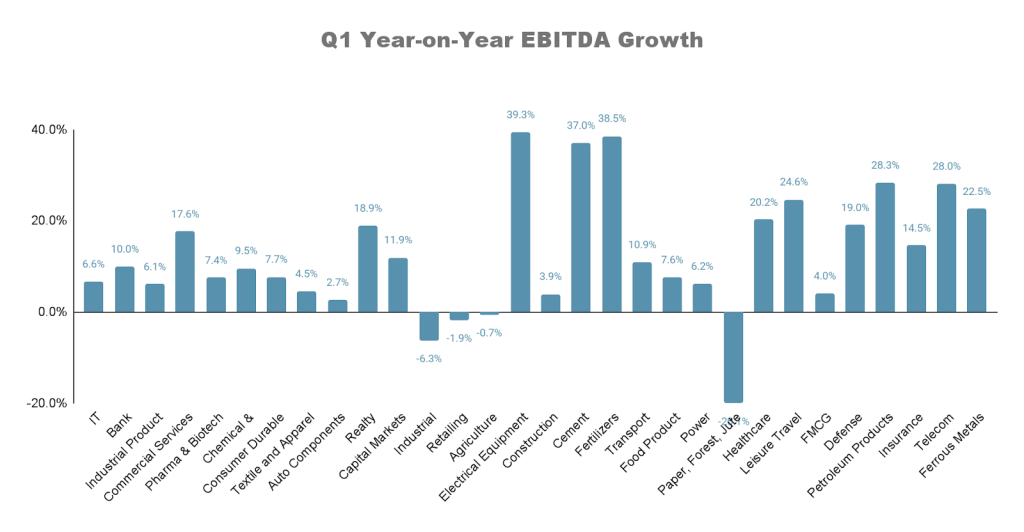

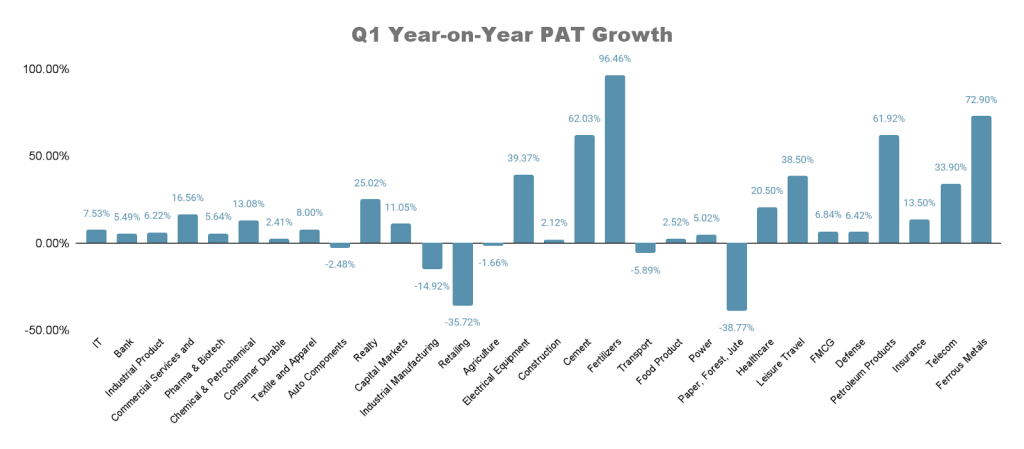

Sectors such as Electrical, Telecom, Healthcare, and Leisure Travel are showing encouraging trends. Electricals are benefiting from strong demand in infrastructure and consumer appliances, while Telecom continues to see steady growth driven by data consumption and digital adoption. Healthcare remains resilient with consistent demand and structural growth opportunities, and Leisure Travel is gaining momentum as consumer spending on experiences rises. Together, these sectors stand out as areas with solid potential and positive momentum.

Sectors like Power and Industrial Manufacturing are not performing well this time. Both are showing weaker momentum compared to others, putting them in the underperforming bracket.

Consumer Durables, FMCG, and Retailing are seeing healthy sales growth, but high margin pressure continues to weigh on performance. While demand remains strong, profitability is under stress, keeping these sectors in a mixed zone.

Sectors like Cement and Fertilizers have shown clear improvement in margins. This margin strength has supported stronger profitability, and as a result, bottom-line growth has outpaced topline performance.

Sectors like Capital Markets, Leisure Travel, Realty, Retailing, and Food Products saw stronger results from larger companies. This suggests that established players hold better pricing power, helping them navigate margin pressures. It also points toward a steady premiumization trend in consumption, with customers favoring stronger brands.

Year-on-Year Sales Growth Across Industries

Year-on-Year EBITDA Growth Across Industries

Year-on-Year PAT Growth Across Industries

The Road Ahead

Looking at the current year-on-year sales growth, things don’t really look that exciting on the sales front. Even though the growth in PAT and EBITDA has been stronger compared to sales, the main focus for any business ultimately has to be on how well sales are growing. Right now, sales seem to be lagging behind, and that could turn into a concern in the short term if the trend continues. But the real question is – how do you see this playing out in the next few quarters?

Key Things to Watch in Coming Quarters

= > Volume vs Price Growth – Are companies selling more units or just raising prices?

= > Gross Margin Drivers – Are margins improving structurally (efficiency) or temporarily (input cost dips)?

= > Working Capital Health – Inventory buildup or delayed receivables could signal weak demand.

= > Capex Conversion – For industrials, order books need to turn into actual revenue.

= > Consumer Trends – Premiumization will benefit large brands, but rural recovery will decide mass-market growth

Conclusion

This quarter shows resilience but also imbalance. Profits are improving faster than sales, and large companies are clearly better placed than small ones. While sectors like Telecom, Healthcare, Electricals, and Leisure Travel are doing well, topline growth remains sluggish overall.

For the story to become truly exciting, we need stronger revenue growth in the coming quarters. Until then, margins and efficiency will keep carrying the load — but they can only do so for so long.

Excellent Ideas 💡

For Right investment right sector

By research analysis