The Indian Government has recently came up with some changes in the Indirect Tax “Goods and Services Tax”, which were announced on 3rd September 2025 by Finance Minister Mrs. Nirmala Sitharaman. The changes are set to begin from 22nd September 2025.

According to the Government, these updates are expected to reduce the prices of many essential items that people use in their daily life. While changing the slab rates, the Government said it focused on improving the life of the common man and giving relief to small businesses and retailers. This move is also being seen by some as a Diwali gift to Indian consumers.

Let’s take a look at what exactly has changed under this new GST reform, and how it afects individual consumers.

What Changes Has the Government Made Under the New GST Reform?

Earlier, GST was divided into slab rates of 5%, 12%, 18%, and 28%. Now, the Government has removed the 12% and 28% slabs, and has introduced a new structure:

=> 5% (for essential goods and services)

=> 18% (for premium goods and services)

=> 40% (for “sin goods” like tobacco and alcohol)

This change is aimed at reducing tax rates on everyday items and making things easier for households.

What’s New Under the Latest GST Reform?

The Government has revised the GST rates in a way that could possibly benefit households, as it aims to reduce taxes on everyday essential items and packaged foods.

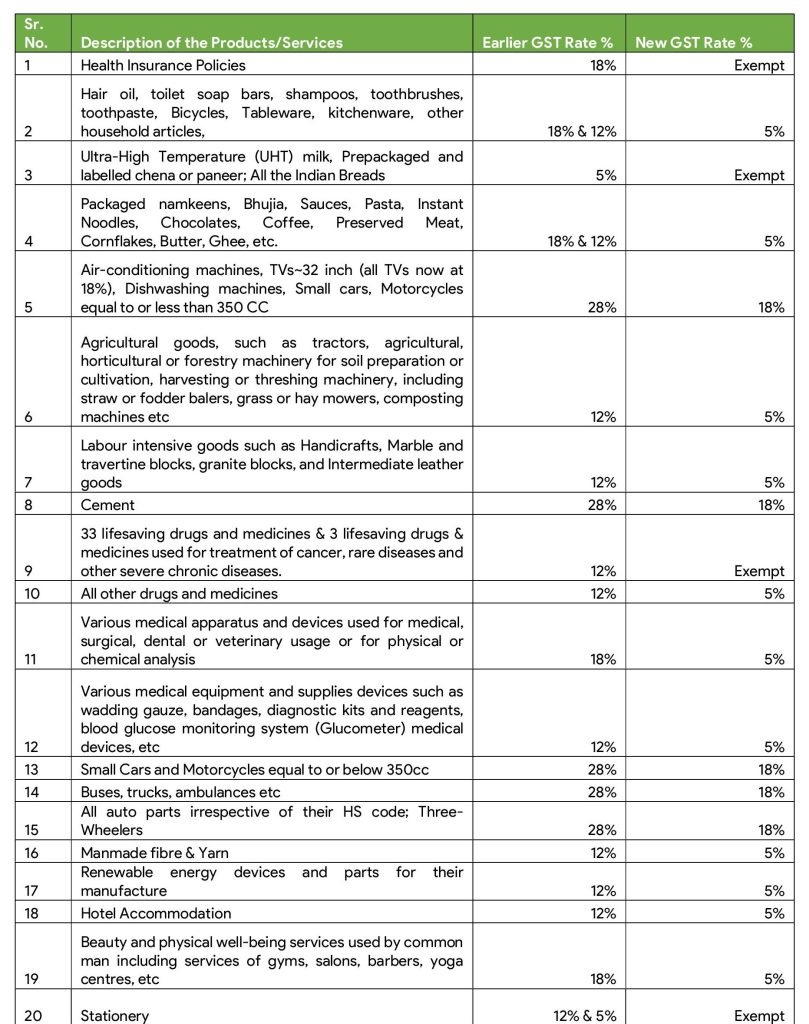

Below is a table showing the earlier tax rates and the new rates applicable from 22nd September on Various Goods:

Source : https://www.pib.gov.in/PressReleasePage.aspx?PRID=2163555

So, In short, the data shows that GST on food and household items has been reduced from 12% or 18% to 5% or even 0%. Consumer items like appliances are now 18% instead of 28%. Materials used in houses are mostly reduced from 12% to 5%, and cement is now 18% instead of 28%. GST on small cars and bikes has come down from 28% to 18%, and tax on agricultural items is also reduced from 12% or 18% to 5% etc.

How Does This Affect Your Pocket?

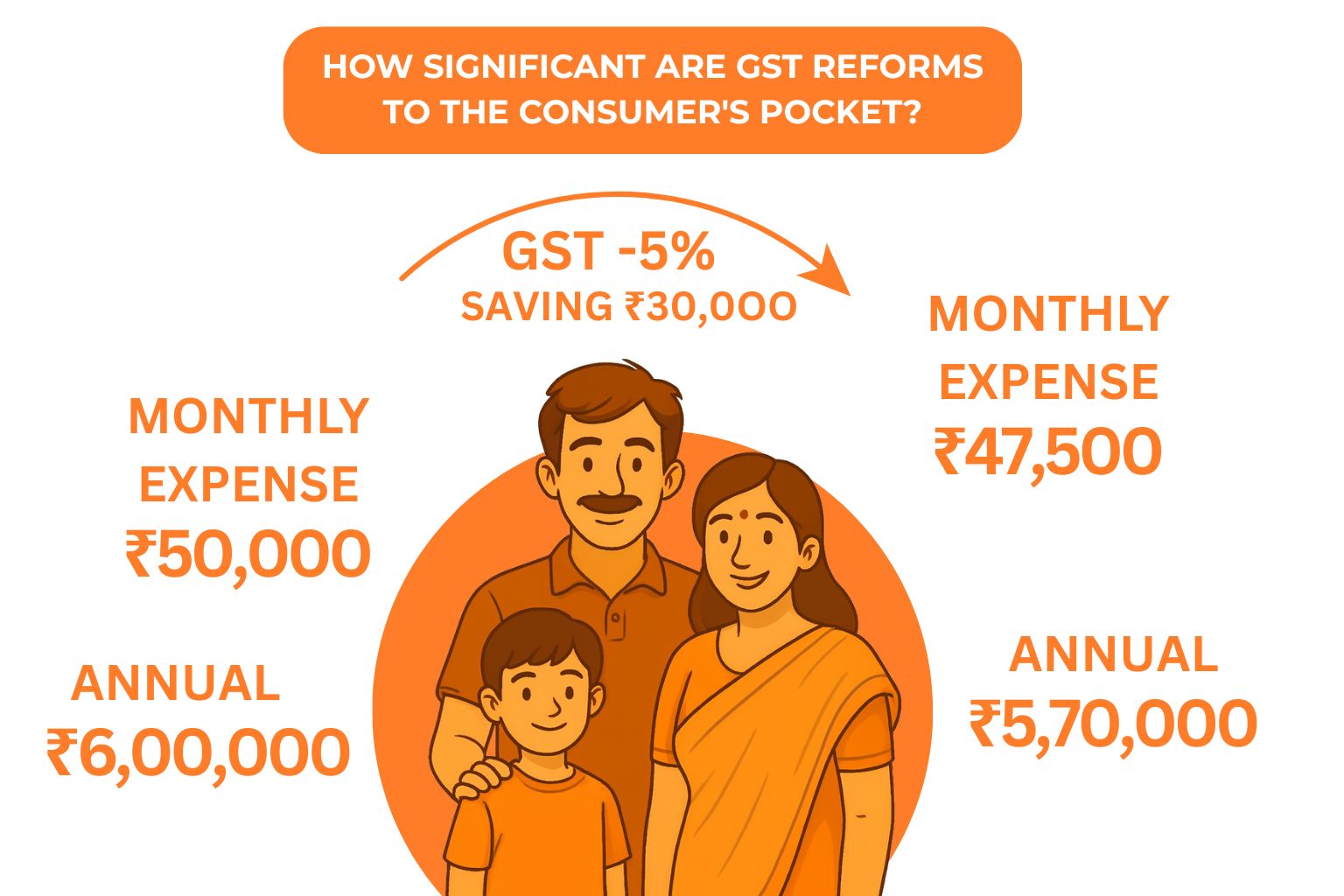

We now know what the new tax rates are. But the real question is — how much does it help an average consumer?

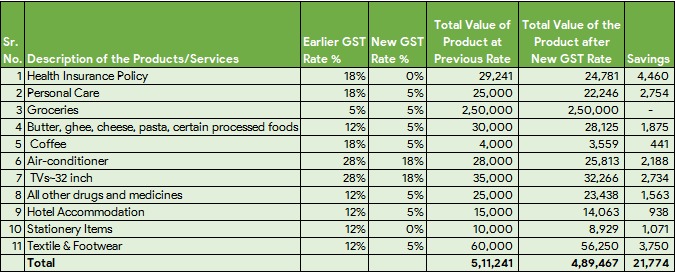

Let’s look at an example. If a family spends on all these items in a year, their total expenses used to be around ₹5,11,241. After the GST changes, the same lifestyle will cost them about ₹4,89,467. This means a direct saving of ₹21,774 per year — without cutting down on any purchases. That’s around a 4-5% saving on household expenses. This saving can lead to higher disposable income, allowing them to spend more on other impoant needs or save for the future.

Conclusion

The recent GST changes made by the Indian Government seem to bring some real benefits to consumers. By reducing tax on essential items, medicines, services, and household products, the reform helps people save money without changing their lifestyle. However, it is important to keep in mind that companies might adjust their prices strategically, which could reduce the actual benefit passed on to consumers. Therefore, while the reform seems promising, we need to carefully watch how these changes play out in real life.

It’s also necessary to see how much of this benefit is truly passed on by retailers and service providers. Only time will reveal how effective this reform is for the common man and small businesses. For now, though, this change seems like a positive step forward.

Disclaimer: The above estimate is based on an average family size of 3 members and typical yearly household spending patterns. Actual savings may vary depending on lifestyle, region, and consumption habits.