IT Sector is the $245 billion Industry captures 56% of the global outsourcing market and is to become a $350 billion to $400 bn industry by 2025-26 and contribute 10% towards the Country’s GDP. From the Previous Year High, the NIFTY IT index declined by approx. 23%, raising concerns among investors about the sector’s stability and growth prospects. In this article, we will analyse how and why this fall happened, whether FII/FPI are pulling out their money from the IT sector, what exactly is happening within the industry, and finally, explore the future outlook for the IT sector. Lets Dive into this.

Recent Performance of NIFTY IT

Right now the IT sector is in a bearish mode, as NIFTY IT has crashed around 23% from its all-time high of 45,995. The index is now trading near its 1-year low of 35,500. Valuations have returned to levels last seen three years ago. Market analysts note that there could be further movement before the sector reaches more attractive valuation levels.

According to the NSDL Data, FPI (Foreign Portfolio Investors) have pulled out nearly ₹63,800 crores from the IT sector between January 2025 and 15 September 2025. This clearly shows the fear among investors, as it is the highest withdrawal compared to all other sectors.

But What are the Reasons behind the fall?

More than 50% of the revenue of Indian IT companies comes from the US – nearly $150 billion out of the $245 billion industry size. This heavy dependence means that whenever the US market faces uncertainty, the impact is quickly felt in the Indian IT sector. For years, US companies have preferred India because of low costs, skilled manpower, 24×7 service, and strong IT expertise. But now, with changing policies and global uncertainties, the sector is facing several challenges that we will discuss in detail below.

1) HIRE Act Bill 2025

In September 2025, the US proposed a law called the Halting International Relocation of Employment (HIRE) Act. The main aim of this Act is to discourage the Outsourcing Services by the US Companies. It would impose a direct 25% tax on the payments US Companies make for service consumed in America from Foreign Firms with the goal of encouraging domestic job growth.

If passed, the bill would put a 25% tax on payments made by US companies for services taken from foreign firms. This means, if a US company outsources to India, the cost could rise by as much as 46% (after tax and deduction disallowances).

Looking Ahead, the bill is only proposed not passed in the US, So we have to take Close eye on this Act.

2) H1B Visa

On September 19, the US Government revise the H1B Visa fees increases it to $100,000 for new applicants ( one time fees ). Actually It’s a temporary work visa/non-immigrant visa that allows employers to temporary hire foreign workers. This visa grants foreign professionals the ability to legally work in the U.S. for a U.S. employer and may serve as a pathway toward a Green Card. Many Companies & Its investors are wondering how it badly affected the sector. The hike in visa fees from the current USD 1,500 will start from January 2026, and it could affect the operations and financials of Indian IT firms in the short term.

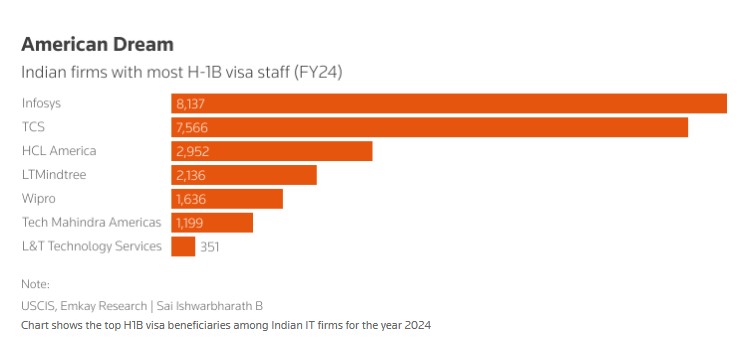

This is the data which showing that Indian firms with most H-1B visa Staff (FY24)

3) Delays in Decision Making

The Big clients in the US & Europe Market are taking time to renew or sign new contracts as they are being cautious with budgets because of economic uncertainty. Despite delays Indian IT Companies multi year contracts in still discussion. In various countries, the global economic slowdown has squeezed client budgets while leading discretionary spending and smaller projects pipeline. Companies worldwide are focusing more on cutting costs rather than spending on new IT projects.

4) Industry Underperformance

Indian IT Sector observed just a growth of 3.8%, which is much less as compared to previous Years. The slowdown is mainly because of weak demand in big markets like the US and Europe, which make up a major part of India’s IT exports. The underperformance is being driven by macroeconomic uncertainties, cautious client spending, and weak results across the industry. From the Previous 2 Years, the Annually & Quarterly Results of the IT Sector revenue growth is disappointing not good as expected mainly due to weak demand and prolonged decisions.

5) Rising Adoption of AI

Clients are increasingly spending on AI-driven transformation (automation, generative AI, analytics). This creates new demand streams for IT players, especially those with AI partnerships (like Infosys with Nvidia, TCS with Microsoft/Google, etc.). AI may not give a revenue boom immediately, but it strengthens the long-term growth story.

What Impact could be Seen on IT Sector Companies?

If companies continue to face such events in the market, they will have no choice but to adapt and move strategically in order to survive and sustain growth. In the following discussion, we will look in detail at the possible impacts on the IT sector.

1) Margins Pressure

Industry Experts & Analyst Expects that the Sudden spike in H-1B visa costs could Impact the Margins of the Company. According to Sandip Aggarwal Fund Manager at Sowilo Investment Managers, estimated the overall hit to Indian IT margins could be in the range of 6–7%.

2) Onshore to Offshore Model or Nearshore

IT Sector Companies Currently Operating in the two Models:

Onshore : Where the IT Companies sent skilled workers to the US to work directly with the Clients.

Offshore : handling work from India at a lower cost.

Now, due to high visa costs, the onsite model has become very expensive. This will disturb the balance of work. Many clients may ask for project price cuts or delay deals until rules become clearer. Some projects may be restructured to reduce onsite staff, while others may shift fully to offshore delivery from India. Companies may also look at nearshore centres (like Canada, Mexico, or Eastern Europe) to continue serving clients at lower costs or Some projects will be redesigned to need fewer people onsite.

3) Hiring Local Talent in the US

To deal with the high cost of sending Indian employees onsite, IT companies might start hiring more local talent in the US. This could include recruiting laid-off H-1B visa holders already in the US or tapping into the local workforce. While this may reduce visa dependency, it could also push up employee costs compared to India.

4) Repricing

If Indian IT companies’ costs go up (like higher H-1B visa fees, compliance costs, or rising employee expenses), then their clients (US or European companies) may not agree to pay the same rates. Instead, they will push back and demand price cuts or renegotiation of contracts to keep their own budgets under control.

Future Outlook

After a 23% fall, IT stocks are no longer looking very expensive, but they are still not in a clear buy zone as analysts say earnings visibility is needed for any strong re-rating. In the short term, the sector is likely to remain under pressure, with muted revenue growth and margins squeezed by rising costs, keeping stock performance sideways to bearish. However, in the mid to long term, steady recovery is expected as the sector stabilizes, supported by digital transformation and AI adoption. Tier-1 IT stocks will continue to act as defensive bets in a volatile market, offering stability and the potential to return to double-digit revenue growth over time.

Conclusion

The Indian IT sector is going through a tough time right now. Because of global uncertainty, US policy changes, and low client spending, the near-term looks difficult. Profit margins are under pressure, companies are changing their business models, and they have to rethink strategies to survive. But at the same time, areas like AI and digital transformation are creating new opportunities, which will support growth in the long run. For now, investors need to stay patient because a quick recovery is not likely. Big Tier-1 IT companies with strong balance sheets will remain safe bets and slowly bounce back as the global situation improves.

The IT sector may look weak today, but it is not finished — the next phase of digital growth could be its big comeback.