Over the period from October 2024 to October 2025, the Nifty 50 has remained almost flat — up barely 2–3%, even after dipping close to 22,000 in March 2025. With the index still trading around the same zone as last year, investor sentiment has understandably turned cautious.

The reasons? Overvaluation, global uncertainties, and profit booking.

In this article, we will discuss why the Nifty and Sensex appear to be in correction mode, whether this is the first time such a fall has happened, the key reasons behind the decline, and most importantly, how investors can benefit from market corrections and what strategies to follow when markets turn bearish.

So, before we dive deeper, let’s first understand what a market correction is and how it differs from a bear market.

A market correction happens when stock prices fall slowly by 10% to 20% from their recent high. It’s a normal part of the market and can actually be healthy. A bear market, on the other hand, is when prices drop quickly and sharply by 20% or more. This usually causes panic and can lead to a longer period of falling markets. It is also often called as Market Crash.

1 Year Nifty Return (%)

The NIFTY 50 currently stands at 25,610.05, up only marginally by 2–3% over the past year (October 2024 to October 2025), offering minimal returns. It had dropped from 26,178 to 21,743.65, a decline of around 20%, and still remains below its 52-week high. Overall, the Indian market has largely moved sideways during this period, leaving investors cautious about whether it will break past its previous highs.

But Why the Market Correct Itself or What’s the Reasons Behind this Market Fall?

The Above Data Represents the Certain Market Falls from 2001 to 2025 includes terrorist attacks, global recessions, banking collapses, and inflation surges. India has had multiple election cycles, demonetization, and economic policy shifts And yet, the average annual return over this entire period is 13.1%.

Market corrections happen on an average approximately every 1 to 2 years & Crashes are occasionally both are considered healthy for a rising market. It happens When the price goes much above the value or intrinsic value, investors may think the stock is overvalued and start taking profits. This high price creates risk of a correction even if fundamentals are okay. It can also happen when the economy slows down, interest rates go up, corporate earnings are weak, or there are global market shocks.

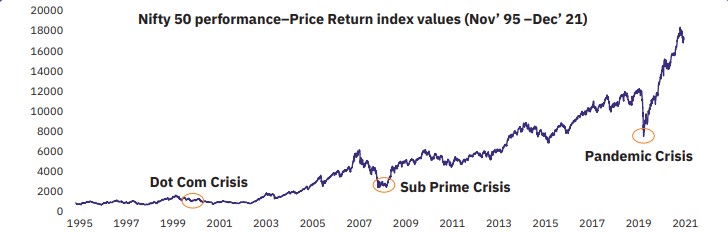

Historically, the Indian stock market has faced three major crashes from 1995 to 2021. The first was the Dotcom Bubble (2000), when IT and internet stocks were hugely overvalued and crashed, wiping out wealth, with the Markets falling around 30–35%—this was a global tech issue, not India’s economy. The second was the 2008 Subprime Crisis, caused by risky US home loans, leading to bank failures and a global market crash, with the Markets dropping roughly 50%. The third was the 2020 COVID-19 pandemic, which disrupted lives and businesses worldwide, causing the Indian Stock Market to fall around 20–25%.

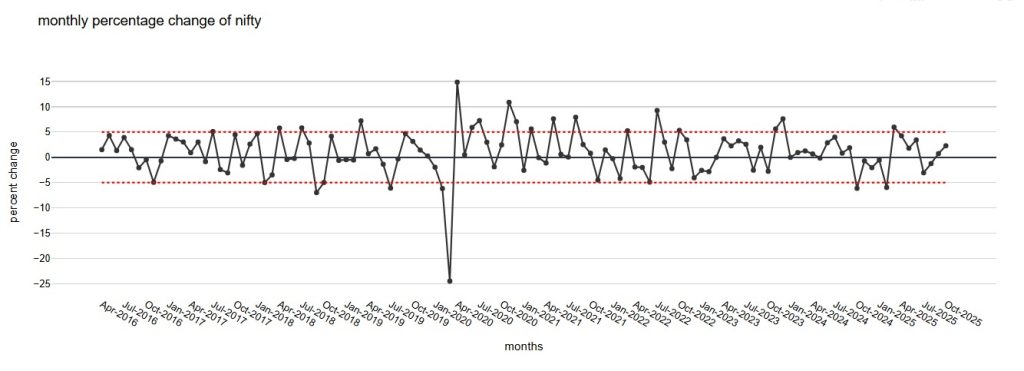

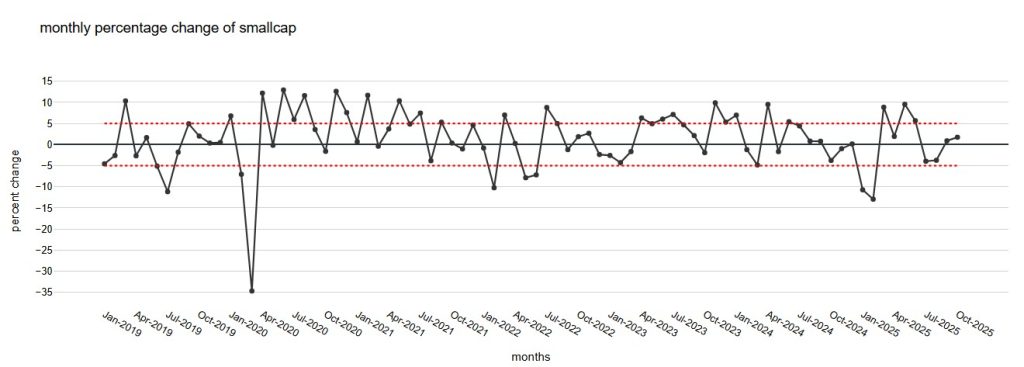

From 2019 to October 2025, the data shows that the Nifty index correct by 5% or more in 7 months, the Midcap index in 8 months, and the Small cap index in 9 months. Each of these corrections presented attractive buying opportunities, as markets consistently rebounded strongly after such corrections. Despite these periodic falls, the indices have demonstrated remarkable resilience — with the sharp recovery highlighting the market’s strong long-term growth trajectory. Historically, whenever the market corrected by around 5%, it tended to bounce back by an even higher percentage.

But Happened Next?

After every major correction, markets have bounced back strongly. When prices fall below their actual value, it creates opportunities for investors to buy undervalued quality stocks, which later push prices higher as confidence returns. Such corrections are actually healthy for long-term growth, as they reset valuations and strengthen the market’s foundation. Historically, despite all these ups and downs, the Nifty 50 has delivered around 15% CAGR over the last 25 years, proving that patience in corrections often leads to strong long-term rewards.

So, it’s a recurring process, and investors should learn to take advantage whenever such opportunities arise but the main question is……….

How to Handle the Market Correction or Crash?

When the Market Crashes, Among All the Investors fear , their emotions run higher , fear overtakes logic But history proves that wealth is built not by avoiding crashes, but by managing them wisely. Here’s how experienced investors and wealth managers approach a downturn:

1) Stay Rational/Not Emotional

Market crashes are part of every economic cycle. Don’t Panic or don’t try to sell at the bottom. A disciplined investor sees volatility as temporary, not terminal. Markets will Recover if the fundamentals are strong of the companies, the correction just clean the excess. Always thinks the long term.

2) Revisit Asset Allocation

Rebalancing your portfolio is important. By spreading your money across Equity, Debt, Gold, and FD, you reduce risk. Example: A 60:25:10:5 portfolio (Equity :Debt :Gold: FD) might fall only 10–12% during a market crash, while a portfolio with only equity could drop 20–25%. Having debt, gold, and FD cushions losses and protects your money.

3) Reassess Business Fundamentals & Buy the Dip

Reassess the Businesses Fundamentals if Any company finds the Attractive to you, which valuations are reasonable try to buy that business More. Focus on Quality not Quantity stick to those companies with strong earnings, low debt, and proven leadership. These recover faster once stability returns, while weak ones fade away. Maintain some liquidity (10–15%) to seize new opportunities and rebalance your asset mix.

4) Stay Invested & Use Systematic Investing

Don’t try to time the market perfectly — it’s almost impossible. Continue your SIPs (Systematic Investment Plans) or invest gradually when markets are down. Crashes give you the chance to buy quality stocks at lower prices, and staying invested allows compounding to work over time. Patience during corrections often rewards long-term investors more than short-term moves.

Conclusion

Market corrections and crashes are a natural part of investing. While they may trigger fear and uncertainty, they also create opportunities for disciplined investors to buy quality stocks at attractive valuations. The key is to stay rational, diversify your portfolio, focus on strong fundamentals, and invest systematically. History proves that patience, planning, and a long-term perspective often reward investors far more than trying to avoid market volatility. Remember, corrections are not the enemy — they are a chance to strengthen your portfolio and build wealth over time.