Recently, the Ministry of Statistics and Programme Implementation (MOSPI) released the latest inflation data, which provides a clear picture of how the prices of goods and services are moving, both for consumers and businesses. Inflation also serves as an important indicator for the economy, helping the RBI to decide which steps to take to support growth and adjust Monetary Policy. When it comes to rate cuts, the RBI mainly monitors CPI inflation, as it reflects the impact of price changes on household spending and overall demand in the economy. That is why, today, we will focus our discussion on CPI inflation and what the recent trends indicate for the RBI’s future actions.

Before diving deeper, it is important to understand some key terms: What is CPI inflation? What are core and non-core components?

What is CPI Inflation?

Consumer Price Index (CPI) inflation measures how much the prices of things people buy every day have gone up over time. CPI inflation targets consumers, not businesses, because it reflects the impact of rising prices on household budgets and everyday spending, showing how the cost of living is changing.

For example, if a biscuit cost Rs 10 last year and costs Rs 12 this year, the Rs 2 increase is due to inflation. CPI is a key reference for RBI policy, as it shows how rising prices affect household budgets and everyday spending, helping the central bank gauge underlying demand in the economy.

Core vs Non-Core Inflation

Core inflation is the inflation which includes all goods and services such as housing, clothing, Healthcare, education, transport, and Other Services etc. except volatile items such as food and fuel, as they fluctuate heavily and react quickly to short-term shocks like weather disruptions, global crude markets, supply-chain issues, and seasonality. These items are highly sensitive to factors outside normal demand–supply patterns, which makes them move sharply month to month.

Non-core inflation is the inflation that includes food and fuel, which react quickly to short-term shocks. This category covers items such as vegetables, fruits, cereals, pulses, dairy products, edible oils and fuel & light.

Latest CPI Inflation Trends

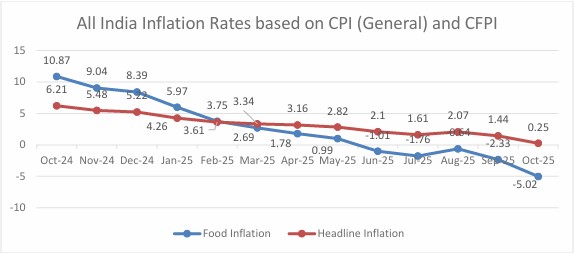

India’s CPI Headline Inflation ( Inflation Including Core & Non Core Inflation ) fells to 0.25% in October 2025 whereas Food inflation fell to -5.02% in the month of October 2025. It is the lowest year on year inflation of the current CPI Series dropped to 10 Year low. This is a reduction of 119 basis points as compared to the September 2025.That is a Huge decline from one year ago, when inflation was above the 6% mark. In just the last four months, inflation has slipped below RBI’s 2-6% tolerance band thrice.

Year-on-year inflation rate based on All India Consumer Food Price Index (CFPI) for the month of October, 2025 over October, 2024 is -5.02% (Provisional). Corresponding inflation rates for rural and urban are –4.85% and -5.18%, respectively. Its means that the Food prices fell slightly less in rural areas than the national average as comparison to Urban Areas.

The fall in inflation is mainly driven by a decline in prices across key food categories, along with a decrease in Rural Inflation, Urban Inflation, Housing Inflation, Health Inflation, Transport & Communication the impact of GST rate cuts, and a favourable base effect. On the other hand, Education inflation has increased slightly, while Fuel & Light inflation has remained stable. Overall, inflation in many items has declined sharply.

What’s Our Intake?

After analysing the latest inflation data, we believe inflation has already hit the bottom and reached its lowest point. The main reason for this cool-down is the sharp correction in food prices, but since food inflation is highly volatile, it is possible that prices may slowly start rising again in the coming months as this temporary softness fades. This suggests that the very low inflation may not last long, and the RBI may prefer to stay cautious rather than rush into rate cuts until the trend becomes clearer.

Moreover, the RBI’s policy decisions do not rely heavily on food inflation, because it is volatile in nature and can reverse quickly; instead, the RBI focuses more on core inflation, which reflects underlying demand conditions in the economy.

What the RBI Could Do Next: Predicting Monetary Policy

Based on the recent data, inflation in India has dropped to a historic low, and overall price pressure is clearly under control. The earlier GST rate and Income Tax slab cuts, along with the CRR reduction, have also not fully passed through the system yet, so a small cut right now could help support growth, improve credit demand, and push investment. Recently released Q2 GDP numbers are extremely strong, highlighting that the economy is already expanding, and there is no urgent need for extra support from the central bank. The combination of growth at the highest in six quarters and monthly inflation at a record low has complicated the task of the Reserve Bank of India (RBI), leaving markets divided about the likely outcome of the Monetary Policy Committee (MPC) meeting this week.

The main aim of the government currently is to increase consumption in the Indian economy, which is visible in several trends. Demand in autos has hit all-time high sales compared to previous years, while rural demand is increasing. High-frequency data also points to strong consumption: record e-way bills, festive auto sales at record levels, rising UPI transaction values, and higher tractor sales, indicating improving rural demand. We think the government will continue to push even more to support consumption.

But at the same time, there are several reasons why RBI may be cautious about cutting rates: high GDP growth means the economy is already expanding strongly, even a small rate cut could put pressure on bank profits because lending rates may fall faster than deposit rates, and there is a risk that inflation may rise in the future due to base effects.

Looking at both the good and bad sides, our view is that the RBI will likely go for a 25 bps rate cut on 5th December 2025. After this, the RBI may pause and avoid cutting more rates in the following months, as they will want to watch how inflation, growth, and the macro behave going forward Or, it could happen that the RBI pauses this time and does not cut rates, as GDP growth is already strong and inflation has bottomed out, with expectations that inflation will rise from here.

Conclusion

Overall, the latest inflation data shows that India is currently at the lowest point of its inflation cycle, largely driven by a sharp fall in food prices and a strong base effect. While this gives the RBI enough room to support growth, the central bank will remain cautious because many of the factors pulling inflation down are temporary, so they will not jump into an aggressive rate-cut cycle

Our assessment is that the RBI is likely to go for a rate cut in the upcoming meeting. However, beyond this, some uncertainties still remain. The RBI’s next steps will most likely follow a wait-and-watch approach, depending on how overall macro conditions evolve