An Industry Overview

As India grows and develops, the need for electricity is increasing very fast. More people are living in cities, the population is growing, and families are using more electrical appliances at home, in offices, and in shops. Industries such as factories, construction, and technology companies also need more electricity to operate.

Electricity use is also rising because more villages now have power connections, electric vehicles are becoming popular, and digital services like mobile networks, data centres, and the internet are expanding. Because of all this, India needs a power supply that is reliable and can grow with demand.

As of October 2025, India has installed electricity generation capacity of about 505 GW. To meet future needs, the government plans to increase this to around 777 GW by 2029–30.

The Critical Role of Transmission in Power Delivery

Electricity is often made far away from where we live and work. Big power plants, like solar and wind farms, are usually built in open areas with lots of land and good sunlight or wind. But most people and factories that need electricity live in cities or towns.

To get electricity from the plants to the people, we need transmission lines. These are like highways for electricity – they carry power over long distances safely and reliably so that everyone can use it. Without these lines, the electricity would stay at the power plant and couldn’t reach homes, offices, or factories.

The Gap Between Generation and Delivery

Even though India is producing more electricity, there are still problems getting it to where it is needed. A report by IEEFA and JMK Research shows that by June 2025, more than 50 GW of renewable energy (like solar and wind) could not be used because the transmission network was not ready.

In FY25, India added only 8,830 kilometres of transmission lines, but the plan was to add 15,253 kilometres. This means the country fell short by 42%.

This shows that India needs to build more transmission lines faster and increase transformer capacity, so the electricity that is generated can reach homes, offices, and factories without any delays or problems.

Transformer Industry: The Backbone of Electricity Supply

Most of the electricity you use every day—for lights, fans, phones, factories, and trains—has to travel a long way from the power plant before it reaches you. But electricity cannot travel safely in its raw form, and this is where transformers come in.

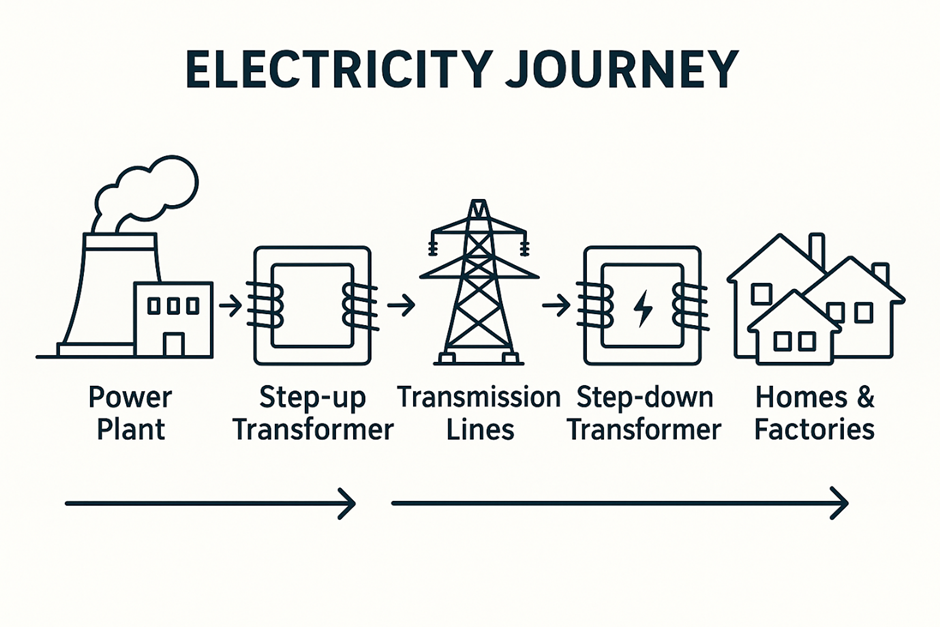

Transformers are machines that change the voltage of electricity so it can move safely and efficiently without changing its type (AC stays AC).

At the power plant, electricity is generated at a certain voltage. Step-up transformers increase the voltage so it can travel long distances without losing power. Later, near homes, offices, or factories, step-down transformers reduce the voltage to a safe level that can be used.

The transformer industry has two main types. Power transformers are the big ones found at large substations. They handle very high voltages and are used to move electricity across cities and states. These are project-based, with fewer units produced, high value, and long manufacturing and testing cycles.

Distribution transformers are smaller and placed closer to homes and factories. They are produced in large numbers, are more competitive, and have thinner profit margins because many small companies can manufacture them.

Transformers are also classified by their size based on their rating in MVA (Mega Volt Ampere). Smaller distribution transformers usually range from a few kVA to a few MVA, while large power transformers can range from 50 MVA to over 1,000 MVA depending on the voltage level and application.

How a Transformer Works

Electricity is first made at power plants using sources like coal, water, or wind. But electricity cannot travel far at the voltage it is first made. That’s why transformers are used.

A step-up transformer increases the voltage of electricity. High voltage is important because it helps electricity travel long distances without losing energy. The electricity then moves through transmission lines that connect power plants to cities and towns.

When electricity gets near homes and factories, a step-down transformer lowers the voltage to a safe level. This ensures that electrical devices can use the electricity safely.

Finally, electricity reaches homes and factories. It powers lights, fans, machines, and other appliances.

Transformers are very important because they make sure electricity can travel far and reach us safely.

India’s Transformer Capacity: Past Growth and Future Targets

| Year | Transformation Capacity (in MVA) | Annual Capacity Addition |

| 2014-15 | 5,96,100 | |

| 2015-16 | 6,58,949 | 62,849 |

| 2016-17 | 7,40,765 | 81,816 |

| 2017-18 | 8,26,958 | 86,193 |

| 2018-19 | 8,99,663 | 72,705 |

| 2019-20 | 9,67,893 | 68,230 |

| 2020-21 | 10,25,468 | 57,575 |

| 2021-22 | 11,04,450 | 78,982 |

| 2022-23 | 11,80,352 | 75,902 |

| 2023-24 | 12,51,080 | 70,728 |

| 2024-25 | 13,37,513 | 86,433 |

India’s power transmission system has been growing steadily over the last ten years. Every year, new transmission lines and transformers are added, and overall, the system keeps getting bigger. In 2024–25, India added 86,433 MVA of new transformer capacity. The government had planned to add 112,435 MVA, so while a lot was achieved, there is still a gap between what was planned and what was actually done.

Required Run Rate & Future Targets

| Particulars | Value |

| Capacity as of FY2025 | 13,37,513 MVA |

| Target Capacity by FY2032 | 24,11,705 MVA |

| Total Capacity to be Added | 10,74,192 MVA |

| Time Period | 7 Years (FY26–FY32) |

| Required Annual Addition (Run Rate) | 1,53,456 MVA / year |

As of 2025, India has about 13,37,513 MVA of transformer capacity. The long-term plan is to reach 24,11,705 MVA by 2032. This means the country needs to add 10,74,192 MVA of new transformer capacity over the next seven years (2026–2032). To do this, the industry will need to add about 1,53,456 MVA every year, which is much more than what was added in the past. This shows that India will need to work faster, invest more, and complete many projects to keep up with the growing need for electricity.

Capacity Expansion by Key Players

| Name | Total Capacity expansion (MVA) |

| T R I L | 37,000 |

| Volt.Transform. | 6,000 |

| Atlanta Electric | 30,000 |

| Shilchar Tech. | 6,500 |

| Bharat Bijlee | 17,000 |

| Indo Tech.Trans. | 7,500 |

| Supreme Power | 6,500 |

| Total | 1,10,500 |

Major transformer companies in India are planning to make more transformers, especially the big ones used in high-voltage transmission lines and large grid projects. Atlanta Electric plans to add 30,000 MVA, and TRIL plans to add 37,000 MVA. Other companies like Bharat Bijlee, Indo Tech Transformers, Shilchar Technologies, Supreme Power, and Voltamp Transformers are also increasing their capacity to meet growing demand from modern power grids, renewable energy, and electricity sent between states.

Altogether, these companies plan to add about 1,10,500 MVA of new capacity. This shows that the industry is getting ready to produce more transformers for bigger projects. However, whether these plans succeed will depend on how fast the projects are finished, market conditions, and new orders.

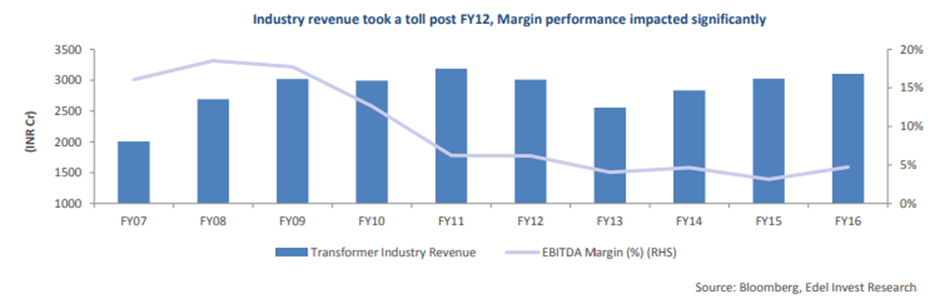

Cyclical Nature of the Industry

The chart shows that the transformer industry goes through boom and bust cycles. Industry revenues grew steadily from about ₹2,000 crore in 2007 to a peak of around ₹3,200–3,300 crore by 2011. This growth happened because a lot of new power plants were built and investments in transmission and distribution increased.

However, profits (EBITDA margins) peaked earlier, in 2008–2009, at about 18–19%, and then fell sharply, even while revenues were still high in 2010–2012. Margins dropped to around 8–9% by 2011–2012 because of rapid capacity expansion, more competition, and lower prices.

After 2012, revenues fell to about ₹2,500 crore by 2013, and profits stayed low at mid-single-digit levels. Although revenues slowly recovered during 2014–2016, they never went back above the 2009 peak, and margins stayed weak. This shows that the industry often has more capacity than needed and struggles to keep high prices. Overall, the chart shows that profits fall before revenues do, highlighting the cyclical nature of the transformer industry.

Company Wise Comparison (Order Book, OPM Margins, NP Margins)

| Name | OPM | NPM last year | Order Book(Cr) |

| T R I L | 16.8% | 10.6% | 5246 |

| Volt.Transform. | 18.8% | 16.5% | 1280 |

| Atlanta Electric | 15.6% | 9.5% | 1643 |

| Shilchar Tech. | 30.8% | 23.6% | 300 |

| Bharat Bijlee | 8.9% | 7.0% | – |

| Indo Tech.Trans. | 13.3% | 10.4% | 830 |

The comparison shows that transformer companies mainly differ in how much profit they make and how strong their future orders are. Shilchar earns the highest profits because it has better pricing and makes specialised products, but its smaller order book may limit future growth. TRIL has the biggest order book, which gives good visibility for future revenues, but its profit margins are only average. Voltamp looks well balanced, with good margins and a strong order book that supports steady growth. Atlanta Electric and Indo Tech are stable players with average profits and moderate order books. Bharat Bijlee is weaker than the others because it has the lowest margins and there is no information on its order book.

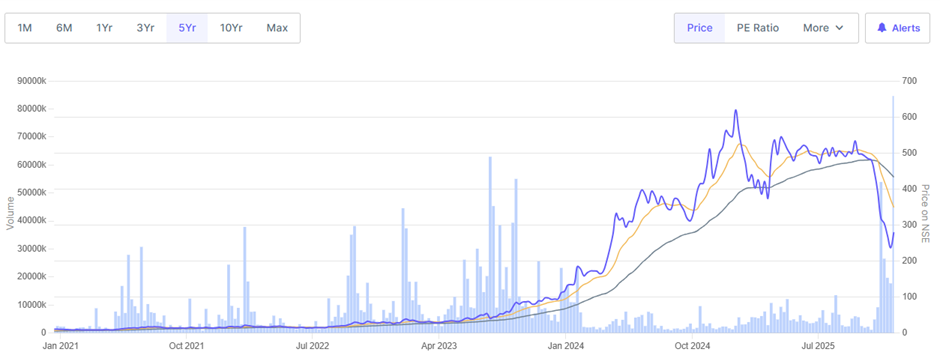

Stock Price Performance (Last 5 Years)

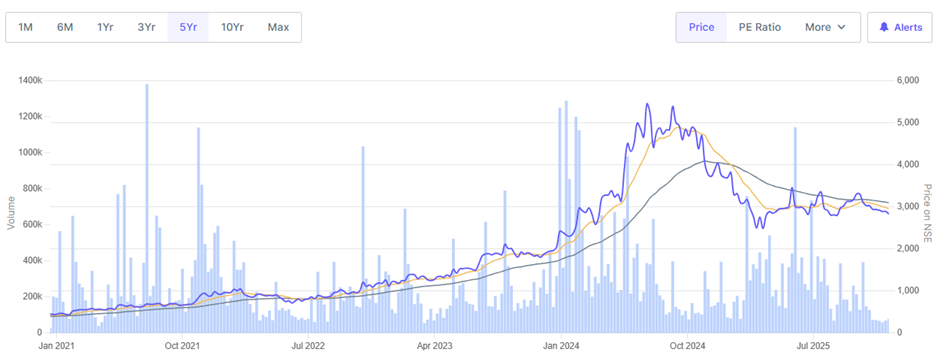

Transformers & Rectifiers India Ltd

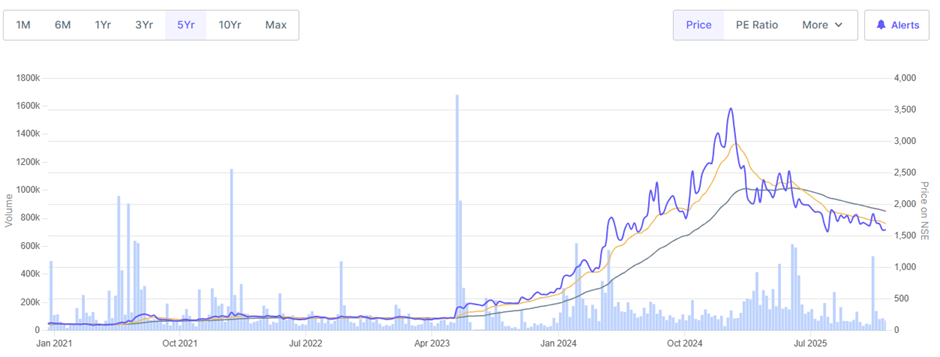

Voltamp Transformers Ltd

Shilchar Technologies Ltd

Bharat Bijlee Ltd

Indo Tech Transformers Ltd

Over the past five years, the Transformer Industry has delivered an average return of 2,303%. This means that an investment in any of these stocks would have yielded significant returns, with the lowest being 523% in Shilchar Tech., and the highest reaching 6,263% in Atlanta Electric.

5-Year Price Returns of Key Transformer Industry Stocks:

| Name | Price Return 5 Years |

| T R I L | 2781% |

| Volt.Transform. | 568% |

| Atlanta Electric | Recently Listed |

| Shilchar Tech. | 6263% |

| Bharat Bijlee | 523% |

| Indo Tech.Trans. | 1381% |

Why Growth May Flatten Going Forward

Most big transformer companies in India are increasing their production capacity, and some are even planning to double it. At the same time, the country needs to add about 1,53,456 MVA of capacity each year to meet national targets. Even though this is a high goal, companies are adding capacity even faster, which could mean there will be more supply than demand in the coming years.

A similar situation happened after 2011, when rapid capacity expansion led to slower growth and lower profits between 2012 and 2014, as shown in the chart with falling revenues and shrinking margins. As the new capacities start working in the next 1–2 years, companies will compete more for orders, which could put pressure on prices and profits. In the short term, companies that can build and deliver transformers faster may do better, but overall industry growth is likely to slow once production levels settle.

What This Means for Businesses and Investors

For investors, this shows that timing and picking the right companies is very important. It is hard to know when new capacities will be fully used or when demand will be highest. Investing at the wrong time could lead to lower returns or money being tied up for too long. That is why careful planning, patience, and disciplined decision-making are needed to handle this phase successfully.

Even if valuations look low, this is mostly because the future of the industry is uncertain. Investors should be careful and not assume that cheap valuations automatically mean safe or profitable returns.

Final Conclusion: Are We Near the End of the Boom?

The transformer industry in India may be reaching the end of its current growth phase. In the past, after periods of rapid capacity expansion—like between 2009 and 2014—demand often lagged, causing too much supply, lower production use, and falling profits. A similar situation is happening today: big companies are increasing production quickly, and some even plan to double their capacity, while the country already needs about 1,53,456 MVA of new capacity each year.

In the short term, companies that work efficiently, have a mix of orders, and can produce quickly may continue to do well. But as new capacity starts operating over the next 1–2 years, competition will increase, which could put pressure on prices, profits, and revenue growth. For investors, this means being cautious, choosing the right companies, and paying attention to how well they operate, since the industry may move from fast growth to slower or more steady growth.

In short, the boom is not over yet, but the period of very high growth may be ending soon, and the industry could enter a slower, more careful growth phase, similar to past cycles.